The implementation of crypto-solution has improved the accurate transactions and secured the critical information of both the parties (i.e Supplier and buyers of factoring process), thus preventing from the financial frauds. Also, adoption of automated solution has not only increased the financial sector but also enhanced the security and planning solution. Innovative solution in financial sector has automated the transaction process in the factoring industry. Blockchain in Invoice factoring is anticipated to offer lucrative growth opportunitiesĪdvent of information technology has revolutionized the financial sector significantly. Fintech solution, on the other hand, allows SMEs to operate the business and negotiate at short margins.

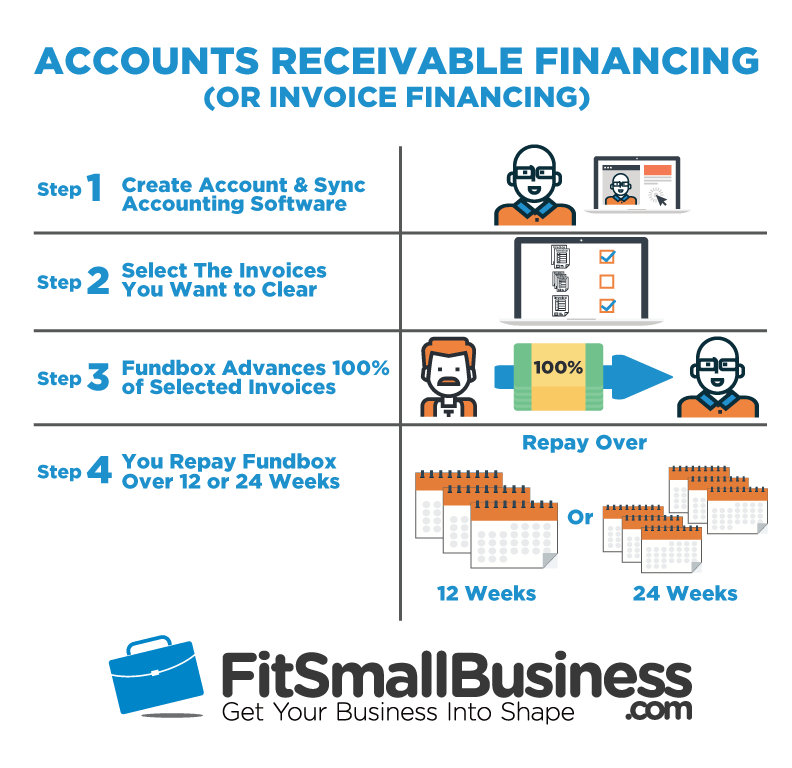

Such kinds of transactions are carried out in a secure manner, recorded in the company’s history to keep track of payments, fees, and amounts dues or earned. Thereafter, the company schedules the payment process with the help of the Fundbox application, which can be paid back in due course of time. If the data fulfils the parameters of the solution, the funds or the loans are made available for the business process. This integration renders Fundbox with precise information regarding the business performance, enabling data-driven decision making concerning continuation or termination of the business relationship with the SMEs.

#Fundbox invoice factoring software

Fundbox allows SMEs to incorporate their accounting software or business bank account to its Fundbox application. FundBox, a U.S.- based company, offers fintech solutions to SMEs. This engenders a win-win situation for the large banks and SMEs to thrive in the factoring industry. The Fintech companies’ offers significant legitimacy and safety solution, which monitors the SMEs transaction process. This allows SMEs to approach fintech companies, increasing the return on investments (RoI) of the factors, such as banks or third party insurers. Fintech offers bulk payment services at reasonable rates. As most of the banks are reluctant to provide many pay checks, an automated solution offered by Fintech solution providers comes into play. For instance, International Fintech, a licensed e-money institution and payment service provider, offers Fintech solutions for the small business owner, offering automated solutions for bulk payments and related services in the financial sector. Most of the payment service providers entrench confidence among small business owners to take their steps in the market.

For instance, the adoption rate of Fintech globally has seen a continuous upward trend, such as, in 2019, the adoption rate of china and India is 87%, whereas for Australia, Canada, Hong Kong, Singapore, the U.K. Growing awareness pertaining to the advancement of financial technology, such as money transfer and payments, budgeting and financial planning, borrowing, saving and investment, and insurance, drives the adoption of Fintech.

#Fundbox invoice factoring download

Get more information on this report Download Sample Report Rising Adoption Rate of Fintech Solution among SMEs is driving the market growth Typically, the commission fees range from 1.15% to 3.5% per month.

The cost of factoring is measured by the financing volume and the credit quality of invoices. The factor pays the 80% of the fund to the seller and remaining 20% fund after the buyer make payment to the factor whereas the interest charged pay at the same time or may be in arrears depends on type of agreement. The seller sells the goods to the buyer, raise the invoices and submit the invoices to the factor in order to raise funds whereas the factor verifies the invoices. It consists of three stakeholders namely seller, buyer and factor. The seller gets immediate funds for the receivable and the factor holds the invoice and makes a small profit. It is estimated to reach an expected value of USD 5603.17 million by 2030, growing at a CAGR of 5.7% during the forecast period (2022–2030).įactoring is a type financial service offered by the banks or the third-party financial service provider in which a seller trades its accounts receivables the factor at a discount rate in order to raise the funds. The global factoring market size was worth USD 3402.2 million in 2021.

0 kommentar(er)

0 kommentar(er)